JumpStart Says Interest in Compact Cars Grows, Could Lead to Uptick in Late 2010 Sales

|

SEE ALSO: Compare 4 Compacts Side by Side

SEE ALSO: e-Carmony: Find Your Perfect Match

SEE ALSO:Americans Want Big Cars...Detroit Wants to Build Big...So Let's Have Big...BUT!

SEE ALSO: Big Family or Lots of Friends - Need a Car?

SAN FRANCISCO--Consumer interest in compact cars has increased considerably this year, according to a compact car segment report recently developed by Jumpstart Automotive Group, an automotive marketing organization.

|

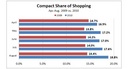

What's more, compact share of shopping on Jumpstart's network of automotive websites improved by 87 percent in August compared to January. When comparing compact shopping to the rest of the primary vehicle segments, it's the only one with any type of significant growth in share over time, while most of the popular segments show little growth year-to-date.

Joe Kyriakoza, Vice President of Marketing Communications & Insights at Jumpstart, says that while compact sales have increased gradually this year, they haven't improved nearly at the pace of shopping activity.

|

Kyriakoza says the last four months of the year could potentially drive a heftier share of market towards compacts if the current shopping demand being revealed results in later term purchases. He says this demand has been driven by many factors, including many new choices of product, heftier marketing support, noticeably better product reflecting OEM investment in the segment, and the CAFE standards that have been set forth by the Obama Administration.

And while the domestic automakers have been underrepresented in this segment in the past, Kyriakoza says things are looking up when it comes to shopper interest in domestic compact cars going forward.

|

Interest in Fiesta has soared on Jumpstart's auto shopping sites over the past eight months as a result of this momentum, with 65 percent growth in July and 30 percent growth in August, versus the year-to-date average. In the month of July, Fiesta was the most researched vehicle on Jumpstar's properties across all categories.

According to Kyriakoza, Fiesta has almost singlehandedly elevated interest in the smallest of the compact vehicle segment ; the subcompact. Share of shopping for Fiesta among subcompacts surpassed historic leaders Yaris, Versa and Fit as of June.

Traditional compact leaders like Honda Civic and Toyota Corolla are not growing at the pace of some new entries in the segment like Fiesta, Kia Soul, Nissan Cube, and the newly launched VW Jetta, yet they are still Nos. 1 and 2, respectively, in overall share of compact shopping.

"In a very irregular economy it's difficult to tell, but all signs point to the compact segment representing a larger share of the sales pie in the coming months," said Kyriakoza. "If trends stay true to historic patterns, the growing interest in compacts during the past four months should lead to an uptick in sales for the remainder of the year."

For a full copy of the Jumpstart Automotive Compact Car Segment Report, including the biggest winners and losers in compact share of shopping across Jumpstart's network of websites for June through August 2010, visit Jumpstart Automotive Group.

About Jumpstart Automotive Group

Jumpstart Automotive Group, part of Hachette Filipacchi Media U.S., is an expert automotive marketing company. It represents the broadest and most diverse audience of in-market car shoppers and influencers across 14 automotive websites that include Vehix, Consumer Guide Automotive, JD Power Autos, Shopping.com Autos, Car and Driver, Road & Track, Cycle World, CarSoup.com, U.S.News.com, HybridCars, CarGurus, TrueCar, PlugInCars and Overstock.com Cars. Fueled by a passion for performance, Jumpstart Automotive Group is committed to the development of quality content and services for consumers and to maximizing publisher revenue and advertiser results through innovative products and services. Additionally, Jumpstart has been on the forefront of behavioral targeting and is now developing leading research and strategic insights products. For more information, visit JumpstartAutomotiveGroup.com.