New-Vehicle Retail Sales On Pace for 1.1 Million, the Strongest October since 2004

|

WESTLAKE VILLAGE, CA -- Oct. 27, 2014: New-vehicle retail sales are expected to reach their highest level for the month of October since 2004, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive.

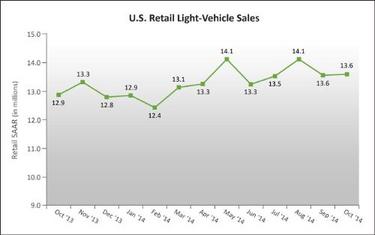

Retail Light-Vehicle Sales

New-vehicle retail sales in October 2014 are projected to come in at 1.1 million units, a 6 percent increase, compared with October 2013. The retail seasonally adjusted annualized rate (SAAR) in October is expected to be 13.6 million units, 0.7 million units stronger than October 2013. Retail transactions are the most accurate measure of true underlying consumer demand for new vehicles.

U.S. Retail SAAR—October 2013 to October 2014 (in millions of units)

Source: Power Information Network® (PIN) from J.D. Power

"The industry continues to demonstrate strong sales growth and robust transaction prices, resulting in another record-breaking month for industry consumer spending," said John Humphrey, senior vice president of the global automotive practice at J.D. Power.

J.D. Power expects consumer spending on new vehicles to exceed $32.5 billion in October, the highest level for the month of October since 2013 when consumer spending reached $30.7 billion.

In addition to overall better economic conditions, Humphrey said growth in retail sales and higher transaction prices are in part due to increasing consumer adoption of longer-term financing which makes purchases more affordable from a monthly payment perspective. Nearly one-third (32.6%) of all vehicles sold in October 2014 are financed with a term of 72 months or longer, tying the record set in July 2014.

Total Light-Vehicle Sales

Total light-vehicle sales in October 2014 are expected to reach 1.27 million units, a 6 percent increase from October 2013. Fleet volume is expected to be 203,000 units, or 16 percent of total light-vehicle sales.

| J.D. Power and LMC Automotive U.S. Sales and SAAR Comparisons | |||

| October 20141 | September 2014 | October 2013 | |

| New-Vehicle Retail Sales | 1,068,400 units (6% higher than October 2013) | 1,013,926 units |

1,012,466 units |

| Total Vehicle Sales | 1,271,500 units (6% higher than October 2013) | 1,243,239 units |

1,205,193 units |

| Retail SAAR | 13.6 million units | 13.6 million units | 12.9 million units |

| Total SAAR | 16.3 million units | 16.4 million units | 15.3 million units |

| 1 | Figures cited for October 2014 are forecasted based on the first 16 selling days of the month. |

"The current environment of the auto industry is one of strength and stability, with the second half of the year at a 16.6 million-unit pace, more than making up for the 16.1 million-unit level in the first half of 2014," said Jeff Schuster, senior vice president of forecasting at LMC Automotive. "The market is clearly seeing a second wave of SUV popularity—with a wide variety of choices across the size spectrum—that will likely dominate market share for the foreseeable future."

North American Production Following very strong sales in August that reduced a significant amount of inventory, North American production in September increased 3.3 percent versus last year, resulting in an increase of over 1.4 million units from September 2013. With the increase in September, production in the third quarter totaled 4.1 million units, a 7.2 percent volume increase, compared with the third quarter of 2013 and the highest third quarter total on record. Compact SUVs experienced the largest volume growth in the third quarter, up more than 90,000 units, compared with the same period in 2013.

LMC Automotive's North American production forecast in 2014 remains at 16.8 million units, a 4 percent increase from 16.2 million units in 2013. North American production for 2015 is forecast to eclipse the 17 million-unit mark, with capacity utilization continuing to run at or above the 90 percent level.

Vehicle inventory at the end of September was at a 64-day supply, up from 56 days at the end of August.