Center For Automotive Research - Estimated Costs of the 2019 UAW-GM Strike

|

Feature Story by Kristin Dziczek

Many estimates of the cost of the UAW strike focus on how much the work stoppage is costing GM, but few have estimated the broader costs of the strike to the U.S. economy or individual states. The Center for Automotive Research’s (CAR’s) estimates put the cost of the UAW-GM strike to the company at roughly USD 450 million a week and the strike pay costs to the UAW strike fund at as much as USD 12 million a week.

The costs of an automaker strike can be comparatively small if the work stoppage is short-lived. If the automaker has sufficient inventory, sales revenue impacts should be relatively minor, and the workers can both makeup for lost production and partially replace lost wages with overtime once they return to work. When a strike lasts beyond a week, it becomes more challenging to make up lost production and costs begin to mount for both the company and the union. The longer a strike lasts, the more it impacts companies and workers in the supply chain as well as the broader economy.

CAR used a dynamic input-output model of the U.S. economy to estimate the impact of the UAW-GM strike.[1] CAR adjusted UAW-GM workers’ compensation to reflect the USD 250 per week strike benefits and modified the effects of GM purchasing to take into account only the reduction in production parts, materials, and services that are not needed while GM’s U.S. plants are not producing a product.

-

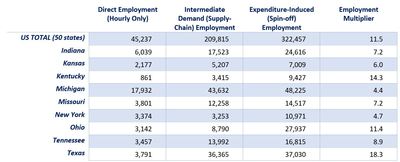

CAR estimates the U.S. employment multiplier for UAW-GM jobs is 11.5, which means that when UAW-GM workers are at work producing vehicles, engines, transmissions, stampings, parts, and components, every UAW-GM job supports 10.5 other jobs in the U.S. economy, with 3.2 of those jobs in the production-focused U.S. supplier sector.[2]

-

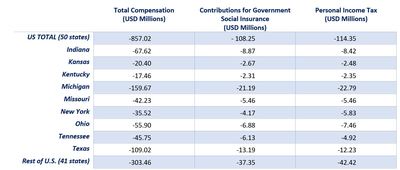

CAR’s results show that overall weekly worker compensation is USD 857 million lower for each week that the strike lasts. That lower compensation is associated with a USD 108 million reduction in tax payments to support government social insurance programs (unemployment insurance, Medicare, Medicaid, and workers’ compensation insurance) and a USD 114 million reduction in personal income taxes paid to state and federal treasuries.

UAW-GM Employment Multipliers

Source: Center for Automotive Research estimates

The state-by-state multipliers vary widely. The concentration of automotive and auto supplier manufacturing in each state, as well as the amount of in-state sourcing and cross-state purchases, influence the magnitude of each of these employment multipliers. Note that each state multiplier includes jobs supported by UAW-GM activity in other states. For example, Indiana’s 7.2 employment multiplier means that the 6.2 additional jobs in the state of Indiana are supported by every UAW-GM worker the United States—not just those who work at UAW-GM facilities in Indiana.

UAW-GM Compensation & Tax Effects

The compensation and tax revenue effects also vary by state, with the vast majority (nearly two-thirds) of the impacts occurring in the nine states in which GM has UAW-represented manufacturing operations. Just over 40 percent of the effects are concentrated in only three states—Michigan, Texas, and Indiana—the three states where GM builds full-size pickup trucks and SUVs, the company’s most profitable products.

- Michigan, with 40 percent of the UAW-GM workforce, is hardest hit by the strike.

- Weekly compensation in Michigan is estimated to decline by USD 160 million while the strike lasts,

- Weekly social insurance tax collections are expected to be USD 21 million lower, and

- Weekly personal income taxes are expected to be USD 23 million lower.

- Texas, with 8 percent of the UAW-GM workforce, has the second-largest economic strike impacts.

- Weekly compensation in Texas is estimated to fall USD 109 million while the strike lasts,

- Weekly social insurance tax collections are expected to be USD 13 million lower, and

- Weekly personal income taxes are expected to be USD 12 million lower.

- Indiana, with 13 percent of the UAW-GM workforce, has the third-largest economic strike impacts.

- Weekly compensation in Indiana is estimated to fall USD 68 million while the strike lasts,

- Weekly social insurance tax collections are expected to be USD 9 million lower, and

- Weekly personal income taxes are expected to be USD 8 million lower.

Table 2 details the weekly compensation and tax effects due to the UAW-GM strike.

Kristin Dziczek

Vice President – Industry, Labor, & Economics