Automotive Advanced Driver Assistance System (ADAS) Market to grow by USD 57.51 billion in 2020, Aptiv Plc and Continental AG Emerge as Key Contributors to Growth | Technavio

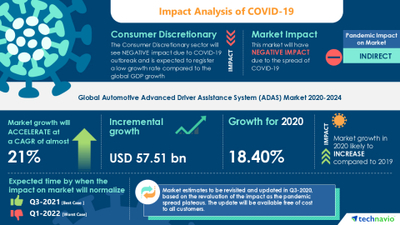

LONDON---Technavio has been monitoring the automotive advanced driver assistance system (ADAS) market and it is poised to grow by USD 57.51 billion during 2020-2024, progressing at a CAGR of almost 21% during the forecast period. The report offers an up-to-date analysis regarding the current market scenario, latest trends and drivers, and the overall market environment. Download a Free Sample Report on COVID-19

Impact of COVID-19

The COVID-19 pandemic continues to transform the growth of various industries. However, the immediate impact of the outbreak is varied. While a few industries will register a drop in demand, numerous others will continue to remain unscathed and show promising growth opportunities. COVID-19 will have a Low impact on the automotive advanced driver assistance system (ADAS) market. The market growth in 2020 is likely to increase compared to the market growth in 2019.

Frequently Asked Questions-

- Based on segmentation by application, which is the leading segment in the market?

- The passenger cars are expected to be the leading segment based on application in the global market during the forecast period.

- What are the major trends in the market?

- Growing development of AI-enabled ADAS solutions is one of the major trends in the market.

- At what rate is the market projected to grow?

- Growing at a CAGR of almost 21%, the incremental growth of the market is anticipated to be USD 57.51 billion.

- Who are the top players in the market?

- Aptiv Plc, Continental AG, DENSO Corp., Hyundai Mobis Co. Ltd., Intel Corp., Magna International Inc., Robert Bosch GmbH, Valeo SA, Veoneer Inc., and ZF Friedrichshafen AG. are some of the major market participants.

- What are the key market drivers?

- Integration of map contents in ADAS is one of the major factors driving the market.

- How big is the APAC market?

- The APAC region will contribute 32% of market growth.

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. Aptiv Plc, Continental AG, DENSO Corp., Hyundai Mobis Co. Ltd., Intel Corp., Magna International Inc., Robert Bosch GmbH, Valeo SA, Veoneer Inc., and ZF Friedrichshafen AG. are some of the major market participants. The integration of map contents in ADAS will offer immense growth opportunities. In a bid to help players strengthen their market foothold, this automotive advanced driver assistance system (ADAS) market forecast report provides a detailed analysis of the leading market vendors. The report also empowers industry honchos with information on the competitive landscape and insights into the different product offerings offered by various companies.

Technavio's custom research reports offer detailed insights on the impact of COVID-19 at an industry level, a regional level, and subsequent supply chain operations. This customized report will also help clients keep up with new product launches in direct & indirect COVID-19 related markets, upcoming vaccines and pipeline analysis, and significant developments in vendor operations and government regulations.

Automotive Advanced Driver Assistance System (ADAS) Market 2020-2024: Segmentation

Automotive Advanced Driver Assistance System (ADAS) Market is segmented as below:

- Application

- Passenger Cars

- Commercial Vehicles

- Technology

- AEBS

- TPMS

- PAS

- Others

- Geographic Landscape

- APAC

- Europe

- MEA

- North America

- South America

To learn more about the global trends impacting the future of market research, download a free sample: https://www.technavio.com/talk-to-us?report=IRTNTR40257

Automotive Advanced Driver Assistance System (ADAS) Market 2020-2024: Scope

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources. The automotive advanced driver assistance system (ADAS) market report covers the following areas:

- Automotive Advanced Driver Assistance System (ADAS) Market Size

- Automotive Advanced Driver Assistance System (ADAS) Market Trends

- Automotive Advanced Driver Assistance System (ADAS) Market Analysis

This study identifies the growing development of AI-enabled ADAS solutions as one of the prime reasons driving the automotive advanced driver assistance system (ADAS) market growth during the next few years.

Technavio suggests three forecast scenarios (optimistic, probable, and pessimistic) considering the impact of COVID-19. Technavio’s in-depth research has direct and indirect COVID-19 impacted market research reports.

Register for a free trial today and gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Automotive Advanced Driver Assistance System (ADAS) Market 2020-2024: Key Highlights

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will assist automotive advanced driver assistance system (ADAS) market growth during the next five years

- Estimation of the automotive advanced driver assistance system (ADAS) market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive advanced driver assistance system (ADAS) market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive advanced driver assistance system (ADAS) market vendors

Table of Contents:

PART 01: EXECUTIVE SUMMARY

PART 02: SCOPE OF THE REPORT

- 2.1 Preface

- 2.2 Preface

- 2.3 Currency conversion rates for US$

PART 03: MARKET LANDSCAPE

- Market ecosystem

- Market characteristics

- Market segmentation analysis

- Value chain analysis

PART 04: MARKET SIZING

- Market definition

- Market sizing 2019

- Market outlook

- Market size and forecast 2019-2024

PART 05: FIVE FORCES ANALYSIS

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

PART 06: MARKET SEGMENTATION BY APPLICATION

- Market segmentation by application

- Comparison by application

- Passenger cars - Market size and forecast 2019-2024

- Commercial vehicles - Market size and forecast 2019-2024

- Market opportunity by application

PART 07: CUSTOMER LANDSCAPE

PART 08: MARKET SEGMENTATION BY TECHNOLOGY

- Market segmentation by technology

- Comparison by technology

- AEBS - Market size and forecast 2019-2024

- TPMS - Market size and forecast 2019-2024

- PAS - Market size and forecast 2019-2024

- Others - Market size and forecast 2019-2024

- Market opportunity by technology

PART 09: GEOGRAPHIC LANDSCAPE

- Geographic segmentation

- Geographic comparison

- Europe - Market size and forecast 2019-2024

- North America - Market size and forecast 2019-2024

- APAC - Market size and forecast 2019-2024

- South America - Market size and forecast 2019-2024

- MEA - Market size and forecast 2019-2024

- Key leading countries

- Market opportunity

PART 10: DECISION FRAMEWORK

PART 11: DRIVERS AND CHALLENGES

- Market drivers

- Market challenges

PART 12: MARKET TRENDS

- Growing development of AI-enabled ADAS solutions

- Integration of map contents in ADAS

- Adoption of V2X technology to enhance ADAS performance

PART 13: VENDOR LANDSCAPE

- Overview

- Landscape disruption

- Competitive scenario

PART 14: VENDOR ANALYSIS

- Vendors covered

- Vendor classification

- Market positioning of vendors

- Aptiv Plc

- Continental AG

- DENSO Corp.

- Hyundai Mobis Co. Ltd.

- Intel Corp.

- Magna International Inc.

- Robert Bosch GmbH

- Valeo SA

- Veoneer Inc.

- ZF Friedrichshafen AG

PART 15: APPENDIX

- Research methodology

- List of abbreviations

- Definition of market positioning of vendors

PART 16: EXPLORE TECHNAVIO