EV Motoring Fairy-Tale Reality - Be Worried Be Very Worried

SEE ALSO: NPR: Lithium Mining Not Good For Humans

SEE ALSO: EV's Dirty Little Secret

“We’re Going to Need A Lot of Lithium. . .”

Special To The Auto Channel

From Gary S. Vastlash

Transportation Editor

Gardner Business Media

(Cue the Jaws theme)

Here’s a quote that plenty of product planners who are penciling the future of electric vehicles:

“It’s almost impossible, and definitely a race against time The big money that needs to be spent takes time to get approval for and to deploy.”

That’s Cameron Perks, an analyst at Benchmark Mineral Intelligence, a firm that specializes in forecasting materials and the supply chains for them. Materials including cobalt, nickel, natural and synthetic graphite, and lithium.

The “almost impossible” part?

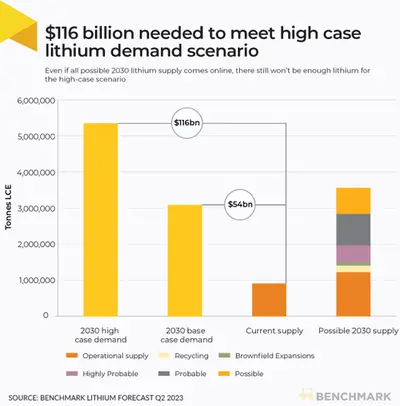

$116-billion by 2030.

That’s the amount of investment that the lithium industry requires—for things ranging from mines to processing—if the global OEMs are going to hit their electrification targets, as well as meet government mandates.

The OEM and policy targets, Benchmark reckons, would mean that global EV sales would represent 82.5% of the market in 2030. That would mean that 5.3 million tonnes of lithium carbonate equivalent (LCE) are needed.

How much LCE is produced now?

915,000 tonnes.

Admittedly the $116-billion is the “high case scenario.” A more modest $54-billion is the “base case.”

Benchmark says that the high case would mean the capacity to produce 7.0 TWh worth of batteries. The base case scenario would be 3.9 TWh.

However, the firm estimates that the way things look at present, there will be the amount of lithium produced in 2030 that would result in 3.2 TWh.

How does this feel?

“As a carmaker, consumer, or EV policy maker, should I be alarmed?

“Yes,” Perks said.