2024 Pied Piper Internet Lead Effectiveness Rankings by Brand - Powersports Industry Study

2024 Pied Piper Internet Lead Effectiveness Rankings by Brand - Powersports Industry Study

-

Image

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

2024 Pied Piper Internet Lead Effectiveness Rankings by Brand - Powersports Industry Study - 5 Year Comparison

-

Image

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

-

Image

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

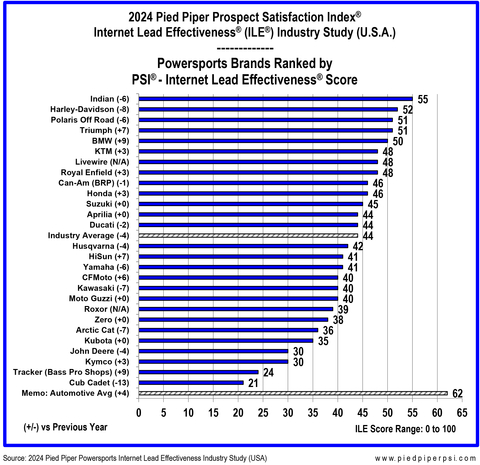

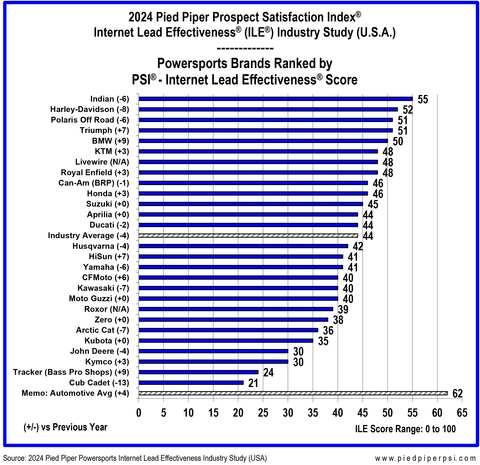

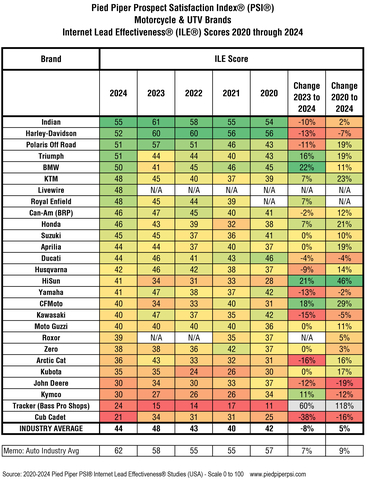

MONTEREY, Calif.--(BUSINESS WIRE)--Polaris Inc’s Indian motorcycle dealerships were ranked highest according to the 2024 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Study, which measured responsiveness to internet leads coming though powersports dealership websites. Following Indian were Harley-Davidson, Polaris Off-Road, Triumph, and BMW.

Pied Piper submitted mystery-shopper customer inquiries through the individual websites of 3,718 powersports dealerships, asking a specific question about a vehicle in inventory, and providing a unique customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone, and text message over the next 24 hours.

Powersports industry average ILE performance declined over the past year. “2024 is a much more challenging business environment for powersports dealers,” said Fran O’Hagan, Pied Piper’s CEO. “New digital retail tools and effective web-response processes are more prevalent today post pandemic, but powersports dealers are challenged to retain skilled employees to use those tools and processes effectively.”

Twenty different quality and speed of response measurements generate dealership ILE scores, which range from zero to 100. Dealerships which score above 80 provide a quick and thorough personal response by email and phone, and often text too. In contrast, dealerships which score below 40 fail to personally respond in any way to their website customers. For top scoring Indian Motorcycle, 24% of their dealerships scored over 80, while 32% scored under 40. In contrast, measurement of the overall powersports industry showed that only 14% of dealerships scored over 80 while 43% scored under 40. “The effort is worth it,” said O’Hagan. “On average, dealerships that score over 80 sell 50% more vehicles to the same quantity of website customers, compared to dealerships that score under 40.”

Brands with the greatest improvement from last year included BMW, Triumph, Honda and Royal Enfield. The performance of eleven of twenty-seven brands declined. Brands suffering the largest drops included Kawasaki, Arctic Cat, John Deere, Harley-Davidson and Yamaha.

Dealerships this year were slightly more likely to respond to online customer inquiries by text message than in previous years. However, the increase in use of text messages was negatively offset by declining performance through other communication channels. Quick response by phone was less common, and use of email to answer customer questions dropped compared to last year. Dealerships industrywide also responded with less quality content on average compared to last year, with only three of sixteen content measurements improving over last year’s numbers.

The most successful dealerships respond to their web customers through multiple channels – text, phone, email - to avoid customers missing an email or text or not answering their phone. In this year’s study, 26% of dealers responded using multiple channels, down from 27% last year. A smaller group, 15% of dealers, not only responded using multiple channels, but did so within 30 minutes, down from 17% last year.

Response to customer web inquiries varied by brand and dealership, and the following are examples of performance variation by brand:

- How often did the brand’s dealerships email an answer to a website customer’s inquiry?

- More than 50% of the time on average: Moto Guzzi, Indian, BMW

- Less than 25% of the time on average: Livewire, Kymco, Yamaha, Zero, Tracker

- How often did the brand’s dealerships text an answer to a website customer’s inquiry?

- More than 30% of the time on average: Royal Enfield, Harley-Davidson, Livewire, Triumph, Zero, Indian

- Less than 10% of the time on average: Kubota, John Deere, Kymco, Cub Cadet, Tracker

- How often did the brand’s dealerships respond by phone call to a website customer’s inquiry?

- More than 50% of the time on average: Tracker, Livewire, Harley-Davidson, Indian, Suzuki, BRP

- Less than 25% of the time on average: Roxor, John Deere, Cub Cadet

- “Did both” - How often did the brand’s dealerships email or text an answer to a website customer’s question and also respond by phone call?

- More than 30% of the time on average: Harley-Davidson, Indian, Livewire

- Less than 10% of the time on average: Cub Cadet, Tracker, Kymco

- “Did at least one” - How often did the brand’s dealerships email or text an answer to a website customer’s question and/or respond by phone?

- More than 80% of the time on average: Royal Enfield, Indian, KTM

- Less than 60% of the time on average: Kymco, John Deere, Zero, Cub Cadet

“Three out of ten powersports web customers today who inquire about a vehicle will be ghosted by the dealership,” said O’Hagan. “Too often a dealership’s response today is nothing, or only an auto-response, the modern equivalent of a form letter.” Pied Piper has found that the key to driving improvement in website response and in turn higher sales is showing dealers what their website customers are really experiencing – which is often a surprise.

The Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Studies have been conducted annually since 2011. The 2024 Pied Piper PSI-ILE Study (U.S.A. Powersports) was conducted between May 2023 and February 2024 by submitting website inquiries directly to a sample of 3,718 dealerships nationwide representing all major powersports brands.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps brands improve the omnichannel sales & service performance of their retailers, by establishing fact-based best practices, then measuring and reporting performance. Examples of other recent Pied Piper PSI studies are the 2024 Pied Piper PSI® ILE® Auto Industry Study (Nissan’s Infiniti brand was ranked first), and the 2023 Pied Piper Service Telephone Effectiveness® (STE®) Powersport Industry Study (Harley-Davidson was ranked first). Complete Pied Piper PSI® industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI® evaluations – in-person, internet or telephone – as tools to measure and improve the omnichannel sales and service effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the fact-based PSI® process, go to www.piedpiperpsi.com.

This press release is provided for editorial use only, and information contained in this release may not be used for advertising or otherwise promoting brands mentioned in this release without specific, written permission from Pied Piper Management Co., LLC.

Contacts

Ryan Scott

(831) 648-1075

rscott@piedpipermc.com